2022/23 Federal Budget – Personal Income Tax Changes

Increase to low and middle income tax offset (‘LMITO’)

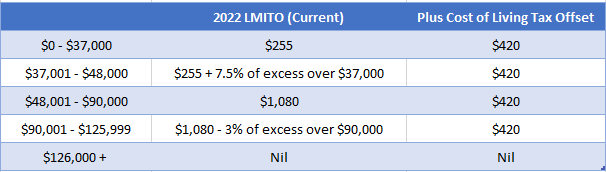

The Government has announced a once-off $420 ‘cost of living tax offset’ for the 2022 income year, which will be provided in the form of an increase to the existing LMITO. This will increase

the maximum LMITO benefit to $1,500 for individuals and $3,000 for couples, and will be paid from 1 July 2022 when Australians submit their tax returns for the 2022 income year.

Other than those who do not require the full offset to reduce their tax liability to zero, all LMITO recipients will benefit from the full $420 increase. All other features of the LMITO remain

unchanged. To the extent an individual is entitled to an amount of LMITO for the 2022 income year under the current law, their entitlement is proposed to be increased by $420, as follows:

The LMITO is not available from the 2023 income year.

Increasing the Medicare levy low-income thresholds

The Government will increase the Medicare levy low-income thresholds for seniors and pensioners, families and singles from 1 July 2021 as follows:

- The threshold for singles will be increased from $23,226 to $23,365.

- The family threshold will be increased from $39,167 to $39,402.

- For single seniors and pensioners, the threshold will be increased from $36,705 to $36,925.

- The family threshold for seniors and pensioners will be increased from $51,094 to $51,401.

For each dependent child or student, the family income thresholds will increase by a further $3,619 instead of the previous amount of $3,597.

Tax deductibility of COVID-19 test expenses

The Government will ensure that the costs of taking a COVID-19 test to attend a place of work are tax deductible for individuals from 1 July 2021. In making these costs tax deductible, the Government will also ensure FBT will not be incurred by businesses where COVID-19 tests are provided to employees for this purpose.