Keeping up with the latest in the accounting news.

Keeping up with the latest in the accounting news.

General

tax policy

Federal Budget 2021 – Changes affecting business taxpayers

Posted by Todd Hodkinson on May 13, 2021

Temporary full expensing extension In the prior year (2020/21) Federal Budget, the Government announced amendments to allow businesses with an aggregated turnover of less than $5 billion to access a […]

Read MoreGeneral

Federal Budget 2021 – Personal Income Tax Changes

Posted by Todd Hodkinson on May 12, 2021

Retaining the Low and Middle Income Tax Offset (‘LMITO’) for the 2022 income year The Government has announced that it will retain the LMITO for one more income year, so […]

Read MoreGeneral

Who do we tax and why?

Posted by Todd Hodkinson on October 13, 2020

Each year, Accountants and Tax Agents approach Federal budget time with both anxiety and optimism. Potential changes may bring not only opportunities for us to help out clients but also […]

Read MoreGeneral

Australian Federal Budget 2020-21 – Overview

Posted by Todd Hodkinson on October 7, 2020

Detail from https://www.charteredaccountantsanz.com Government is spending big on infrastructure, job creation, asset write-offs and personal tax cuts In Brief A record $213.7 billion deficit and net debt predicted to peak […]

Read MoreGeneral

Businesses now able to claim JobKeeper for new employees

Posted by Todd Hodkinson on August 17, 2020

A legislative instrument was registered on 14 August 2020 amending the JobKeeper rules to allow businesses to claim the subsidy in respect of new employees. The changes apply to JobKeeper […]

Read MoreGeneral

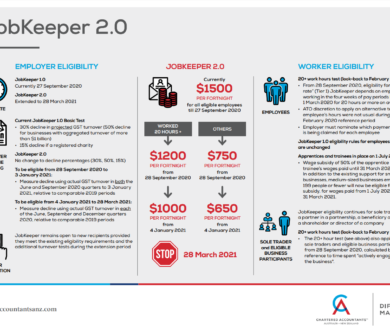

JobKeeper 2.0

Posted by Todd Hodkinson on July 22, 2020

Some important announcements yesterday for those businesses who continue to be affected by COVID-19 restrictions. The well received and targeted JobKeeper program has been extended for those business that continue […]

Read MoreGeneral

What do I need to bring to my tax appointment?

Posted by Bianca Prajbisz on July 8, 2020

As the Australian Taxation Office continues to access more of your information every financial year, it can be confusing what information you need to bring for us to complete your […]

Read MoreGeneral

JobKeeper: Alternative Tests

Posted by Todd Hodkinson on April 26, 2020

One of the major issues that was immediately highlighted with the JobKeeper package was that the initial test for being an eligible business wouldn’t necessarily fit all business scenarios. Upon […]

Read MoreGeneral

How to receive the JobKeeper Payment – including key dates

Posted by Bianca Prajbisz on April 17, 2020

As the Treasury and ATO continue to roll out the JobKeeper payment, confusion around the practical application of receiving it and passing it onto your staff follows close behind. Here […]

Read MoreGeneral

Jobkeeper allowance – Is the devil in the detail or more the fear of the unknown?

Posted by Todd Hodkinson on April 17, 2020

If there’s one term that any Tax Agent cringes at, it’d have to be “Commissioners discretion.” This is because we don’t like uncertainty, that’s why we play with numbers all […]

Read More

Email Us

Get In Touch

(07) 4766 8133

Alternatively send us an email and one of our friendly staff will get back to you as soon as possible.

Email Us