Keeping up with the latest in the accounting news.

Keeping up with the latest in the accounting news.

General

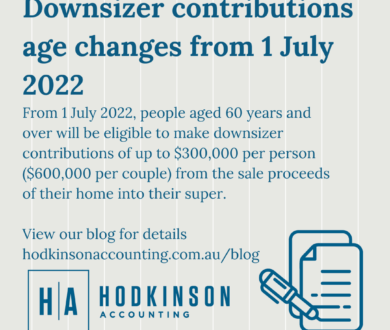

Downsizer contributions age changes from 1 July 2022

Posted by Todd Hodkinson on July 4, 2022

Downsizer contributions age changes from 1 July 2022 From 1 July 2022, people aged 60 years and over will be eligible to make downsizer contributions of up to $300,000 per […]

Read MoreGeneral

ATO to target ‘wash sales’ this Tax Time

Posted by Todd Hodkinson on July 4, 2022

ATO to target ‘wash sales’ this Tax Time The ATO is warning taxpayers to not engage in ‘asset wash sales’ to artificially increase their losses to reduce gains (or expected […]

Read MoreGeneral

ATO updates ‘cents per kilometre’ rate for individuals

Posted by Todd Hodkinson on July 4, 2022

ATO updates ‘cents per kilometre’ rate for individuals The ATO has updated the cents per kilometre rate relating to individual car expenses for the 2023 income year to 78 cents […]

Read MoreGeneral

ATO targeting SMSFs that fail to lodge annual returns

Posted by Todd Hodkinson on July 4, 2022

ATO targeting SMSFs that fail to lodge annual returns The ATO has observed an increase in the number of SMSFs that fail to lodge their first annual return and become […]

Read MoreGeneral

ATO’s small business focus for 2022 income year

Posted by Todd Hodkinson on July 4, 2022

ATO’s small business focus for 2022 income year The ATO announced that it will be focussing on the following matters for small business tax returns for the 2021/22 year: Deductions […]

Read MoreGeneral

Fuel excise & unintended consequences

Posted by Todd Hodkinson on April 1, 2022

Fuel excise & unintended consequences While majority of the country will enjoy the slight reprieve on cost of living thanks to the fuel excise reduction in the recent budget announcement, […]

Read MoreGeneral

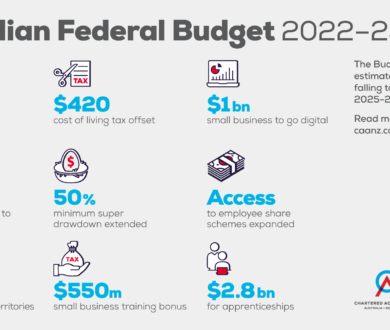

2022/23 Federal Budget – Other budget announcements

Posted by Todd Hodkinson on March 30, 2022

2022/23 Federal Budget – Other budget announcements Extending the reduction in minimum drawdowns The Government will extend the 50% reduction of superannuation minimum drawdown requirements for account-based pensions (‘ABPs’) and […]

Read MoreGeneral

2022/23 Federal Budget – Changes affecting business taxpayers

Posted by Todd Hodkinson on March 30, 2022

2022/23 Federal Budget – Changes affecting business taxpayers Skills and training boost The Government will introduce a skills and training boost to support small and medium-sized businesses to train and […]

Read MoreGeneral

2022/23 Federal Budget – Personal Income Tax Changes

Posted by Todd Hodkinson on March 30, 2022

2022/23 Federal Budget – Personal Income Tax Changes Increase to low and middle income tax offset (‘LMITO’) The Government has announced a once-off $420 ‘cost of living tax offset’ for […]

Read MoreGeneral

SA COVID-19 Economic Support Measures

Posted by Todd Hodkinson on August 20, 2021

COVID-19 Business Support Grant – 20 July 2021 The Federal Government may declare these otherwise assessable grants to be tax-free Questions regarding the Business Support Grant can be sent to […]

Read More

Email Us

Get In Touch

(07) 4766 8133

Alternatively send us an email and one of our friendly staff will get back to you as soon as possible.

Email Us